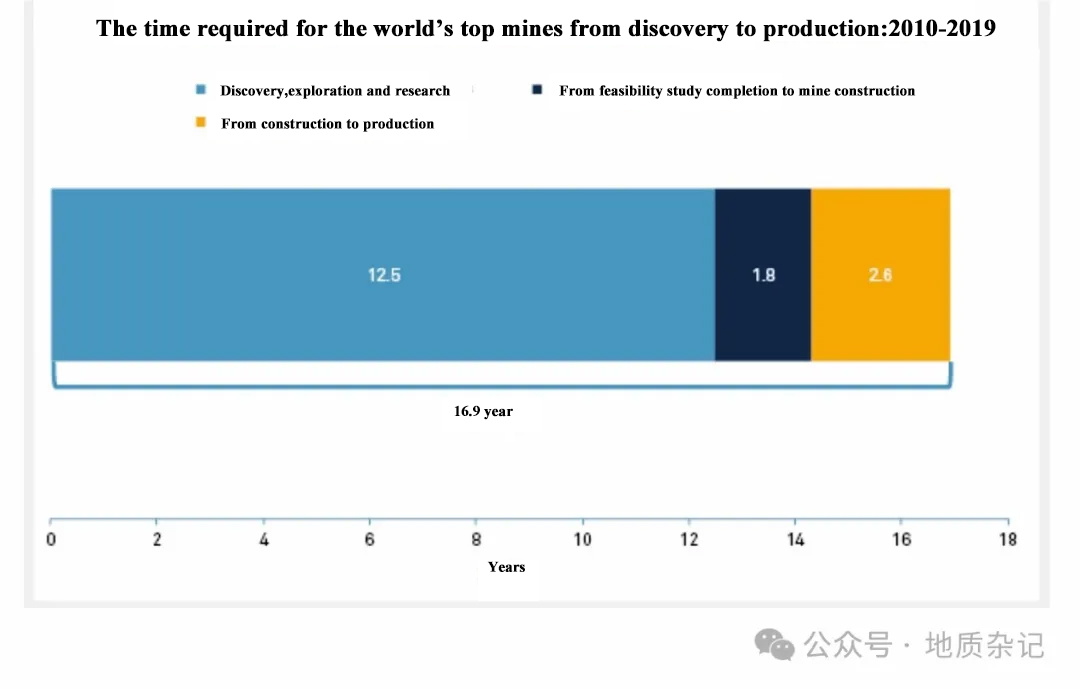

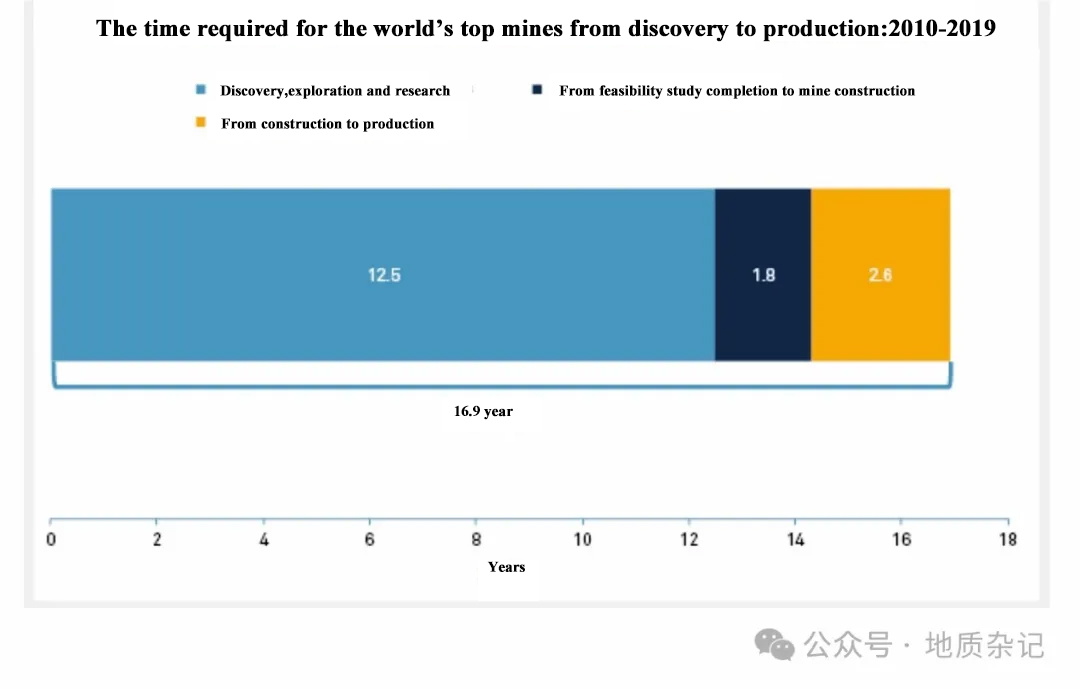

The Average Time Required for the World's Top Mines from Discovery to Production is 16.9 Years

Jun 25, 2024

The Average Time Required for the World's Top Mines from Discovery to Production is 16.9 Years

Jun 25, 2024

From 2010 to 2019, more than 200 new gold, copper, zinc, nickel, and copper mines entered commercial production, with an estimated total ore production of 22 billion tons. The lead time from initial discovery to production varies for each mine, depending on a variety of factors, including product and mine type, geographic location, partnership history, government and community needs. The average time from discovery to production for the world's 35 largest mines is 16.9 years, with the shortest being 6 years and the longest being 32 years. In order to avoid large data deviations, some mines are not included in the calculation of the time required for top mines, mainly because the projects were abandoned after the initial discovery.

(Note: Data as of March 2020)

Many factors affect the time it takes to deliver a mine

The average exploration and research time for the world's 35 top mines is 12.5 years, almost three-quarters of the total time invested. Mines that spend the longest time in this stage usually experience multiple changes in ownership and research revisions.

Generally speaking, top mines enter the mine construction phase 1.8 years after the feasibility study is completed. Ideally, construction can begin shortly after the feasibility study is completed; but for some mines, it takes another 3 to 5 years before construction, partly because they want to continue to increase reserves before construction, or face problems such as mining permits, licenses, funding and community protests.

Of the 35 top mines, 20 mines take less than or equal to the average time of 16.9 years, among which mines in Peru have the shortest delivery time, with about four-fifths of the mines taking an average of 13 years. The Las Bambas copper mine in Apurimac has been in commercial production since 2015, when a large amount of porphyry copper was discovered in 2005 (skarn copper was discovered earlier). It is the mine with the shortest delivery time and currently ranks third in Peru in ore production.

Australia has opened two mines in recent years, with an average time of 10 years. The Gruyere JV gold mine in Western Australia is a 50-50 joint venture between Gold Fields Ltd. and Gold Road Resources Ltd. It took only six years from the discovery of gold in 2013 to commercial production in 2019. Although there are many deeper deposits that have been put into production, Australia's deposits tend to be near-surface oxides that are easier to explore and develop.

Although Australia does not have a fully integrated federal licensing system, the official assessment of exploration and mining is much faster than in other developed countries. As noted in a 2015 study prepared for the U.S. National Mining Association, evaluations of exploration plans and mining proposals in Western Australia were completed in just 30 working days. Environmental impact assessments (EIA) are completed by the applicant and submitted to the relevant agencies for evaluation, shortening the application process.

Fifteen mines exceeded the average lead time. Chile topped the list. The country's three mines had long lead times during this period, averaging 23.7 years. Mexico followed with two mines, averaging 17.5 years. Canada and Russia both approved four mines for production during this period, and both had two mines that took longer than average: two Canadian mines with an average lead time of 23.5 years, and two Russian mines with an average lead time of 27.5 years. Russia’s Bystrinskoye copper mine took 32 years from its discovery in 1986 to commence operations in 2018.

Like Australia, Canada uses a streamlined permitting process and timeline, but the permitting process can involve extensive community collaboration and environmental requirements that can lead to significant delays. Canada’s Rainy River and Dublin Gulch mines took 22 and 25 years to complete, respectively.

Ontario’s Rainy River mine is owned by Rainy River Resources Ltd., which chose to continue exploration and feasibility work in the area when it was unable to finance mine development. New Gold Inc. acquired the mine in 2013 and has conducted the latest feasibility study, permit application, testing and construction. Victoria Gold also revised its feasibility study for its Dublin Canyon mine several times between 2011 and 2016, subsequently securing financing and commencing construction shortly thereafter. As a result, the average time from feasibility study completion to production for both mines was only 2.5 years.

Most new mines are open pit mining, and copper mines require longer lead times

Of the 35 top mines counted, 31 are open pit mines, with varying ore production capacities and mining cycles. The Las Bambas copper mine has an annual production capacity of 51 million tons of ore, and it took 10 years from discovery to production. In contrast, the Bystrinskoye copper mine, with an annual production capacity of 10 million tons, has a delivery period of 32 years. The average ore production capacity of the top open pit mines is 19.1 million tons/year, and the average delivery time is 17.4 years.

Only two mines have both open pit and underground mining, and both mining methods contributed to production capacity during the trial mining period. The Kibali gold mine in the Democratic Republic of Congo and the Sukari gold mine in Egypt have lower production capacities, with annual ore production of 7.2 million tons and 12.3 million tons, respectively, and delivery cycles of 15 years and 12 years, respectively. Some open-pit mines, such as Oyu Tolgoi and Yuji River in Mongolia, plan to increase underground mining in the near future.

There are two other pure underground mining mines, Carrapateena in South Australia and New Afton in British Columbia, Canada, both of which have low production capacity of only 4 million tons of ore per year and an average delivery time of 13 years.

Of the 35 new mines, 23 are gold mines (accounting for two-thirds of the total), 10 are copper mines, and 2 are nickel mines. Among them, the average delivery time for gold mines is 15.4 years and that for copper mines is 18.4 years. The difference between the two is mainly due to the longer exploration and feasibility study time for copper projects, which is an average of 2 years longer than that for gold projects. One reason is that, at least in the exploration stage, the availability of funds for gold projects is better than that for copper projects. This is supported by exploration data from the past 10 years. The data shows that the ratio of grassroots exploration to late-stage exploration budgets for copper and gold mines is an average of 1:1.8, which reflects the better funding supply for gold exploration. In addition, gold prices have been more resilient than copper prices over the past 10 years, which has eased capital flows for gold mines. In addition, the construction time of copper mines is also one year longer than that of gold mines on average.

The Average Time Required for the World's Top Mines from Discovery to Production is 16.9 Years

Jun 25, 2024

The Average Time Required for the World's Top Mines from Discovery to Production is 16.9 Years

Jun 25, 2024